Technology that enhances human capabilities and drives modernization.

About the Study

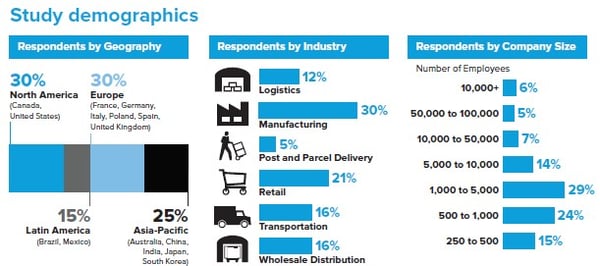

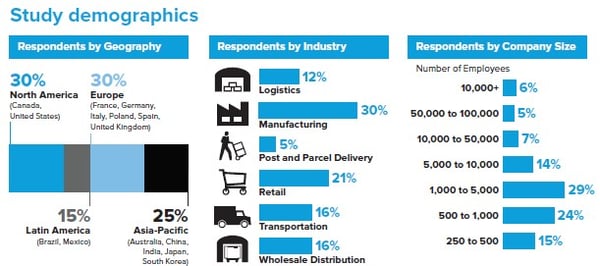

Zebra Technologies commissioned a global research study to analyze the trends and challenges that

are transforming warehousing operations. The study asked 1,403 IT and operational decision makers from manufacturing, transportation and logistics, retail, post and parcel delivery, and wholesale distribution industries for their insights on current and planned strategies for modernizing their warehouses, distribution centers and fulfillment centers from 2019-2024.

Top Trends

DRIVERS

46% cited faster delivery to end-customers as the primary factor driving their growth plans

CHALLENGES

60% reported labor recruitment and/or labor efficiency and productivity among their top challenges

STRATEGIES

80% of organizations are planning to invest in new technologies to be competitive

PLANS

Partial Automation and Augmentation (Equipping workers with devices and technology)

61% will rely on a combination of humans and technology by 2024

Full Automation (No human involvement)

27% plan to utilize full automation by 2024

State of the industry

Warehousing, distribution and fulfillment operations are undergoing a modern-day makeover as they transform to meet the growing demands of the world’s instant gratification, on-demand economy. Faced with an evolving omnichannel landscape, ever-increasing volumes, faster delivery requirements and a global shortage of workers, industry leaders must modernize to keep pace.

Turning the Supply Chain Upside Down

Turning the Supply Chain Upside Down

Consumers’ seemingly insatiable demands for 24/7 product search and purchase have upended the supply chain, impacting manufacturers, retailers and the warehousing operations that serve their needs. The digital revolution also has far-reaching implications for business-to- business enterprises who need to quickly produce, store and ship inventory with pin-point precision. The “I want it now” mentality stretches across all industries and requires savvy leaders to effectively manage the bottom line and deliver a solid return on investment (ROI) while keeping customers satisfied.

Respondents to Zebra’s Warehousing Vision Study cited the need to modernize operations by deploying innovative technologies that drive positive outcomes. The study found that 40% of respondents reported an increase in consumer demand as a top driver for growth. Over one-third of those surveyed stated that shorter order lead times are fueling their expansion plans and causing them to rethink their strategies.

Expanding Operations to Support Dramatic Growth

Both automation and worker augmentation solutions are a vital focus for decision makers’ plans during the next five years. More than three-quarters (77%) of respondents agree that augmenting workers with technology is the best way to introduce automation in the warehouse, but only 35% percent of respondents have a clear understanding of where to start automating.

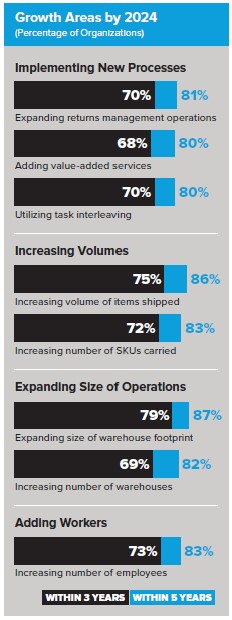

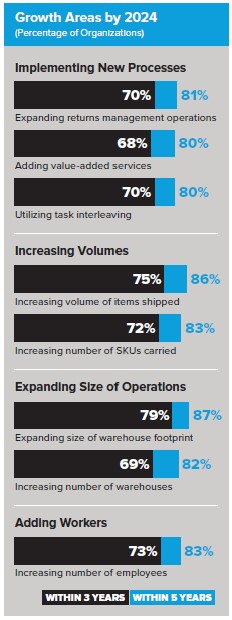

Decision makers also report increasing the warehouse footprint and adding new facilities. Currently, there are over 3.5 million warehouses globally.1 Eighty-seven percent of decision makers surveyed are in the process of or planning to expand the size of their warehouses by 2024, with 82% anticipating an increase in the number of warehouses during this timeframe.

As companies invest in infrastructure, it’s imperative they invest their capital in ways that ensure growth and guarantee a healthy ROI. This sentiment is top of mind for decision makers, as 59% of respondents also named capacity utilization as one of their top expected challenges over the next five years.

Investing in People Is Critical to Meeting Demand

Expanding space, implementing new processes and enhancing workflows are only part of the equation. Leaders also need to invest in new workers. Today, there are just over 38 million warehouse workers and projections call for 44.6 million by 2023. Not surprisingly, the study revealed 83% of respondents are currently increasing or plan to increase the number of employees by 2024.

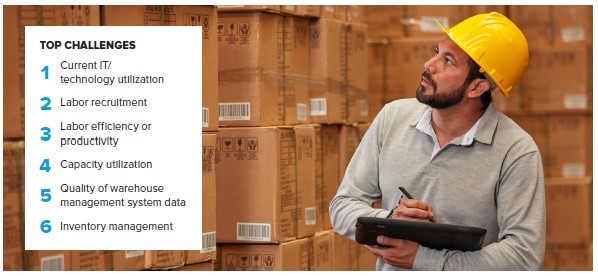

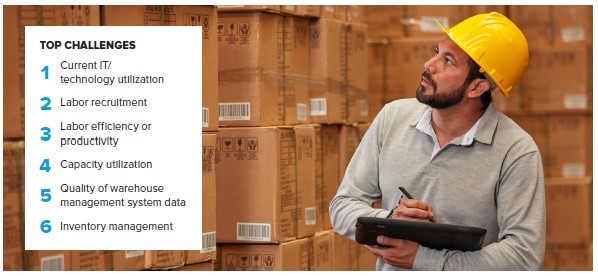

Rising demand ushers in new operational challenges

As warehouses get larger, labor issues, IT/technology utilization, capacity usage and supply chain visibility are cited as the most significant operational challenges now and within the next five years. Industry leaders must skillfully balance day-to-day responsibilities with their longer-term modernization plans to ensure seamless operations and avoid supply chain disruptions.

Making the Most of Expansion

While warehouse expansion solves some issues, adding more space to a warehouse is just one step towards meeting the needs of the on-demand marketplace. The real challenge is optimizing the use of that space. In the near term, that means implementing technology that increases visibility, enhances productivity and provides the intelligence and flexibility to effectively navigate the ever-changing needs of warehousing.

As they contemplate future enhancements, decision-makers realize that they need to evaluate their existing infrastructure. Modernizing a warehouse is, by nature, a gradual process. Although introducing new technology may introduce new challenges, it is the only way to achieve the desired long-term outcomes for increased asset visibility, real-time guidance and data-driven performance. The ability to leverage operational data also plays a crucial role in creating a more productive workforce and more efficient operations.

61% of respondents agree IT/technology utilization is their biggest operational challenge now and within the next five years

The Labor Equation

As companies retrofit, expand and build new facilities, there is a growing need for more employees and technology solutions that will help them become more productive. Currently, 60% of respondents cite labor recruitment as an important operational challenge that will affect them over the next five years.

Hiring new employees is only the beginning. Sixty percent of decision makers also identified labor efficiency and productivity as a top challenge. As warehouse leaders introduce a modern workforce to new technology, the majority of respondents see this as an opportunity to optimize workflows.

With leaders reporting an average of four- and-one-half weeks for workers to reach full productivity for inbound and outbound operations, they know they need to make a change in a volatile market where turnover is prevalent. In fact, 63% want to improve individual worker or team productivity today while also achieving workflow conformity.

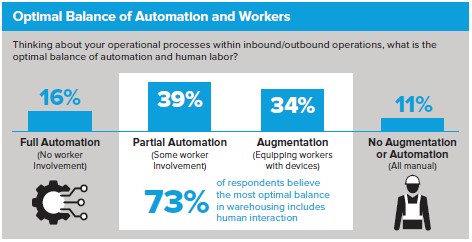

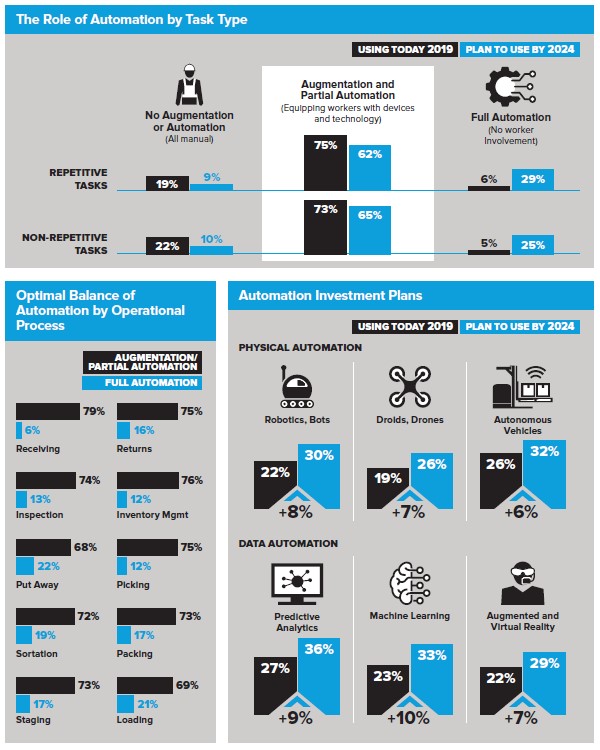

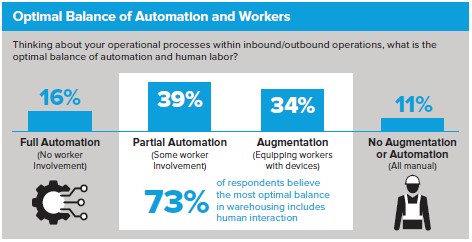

The harmonious union of technology and front-line workers

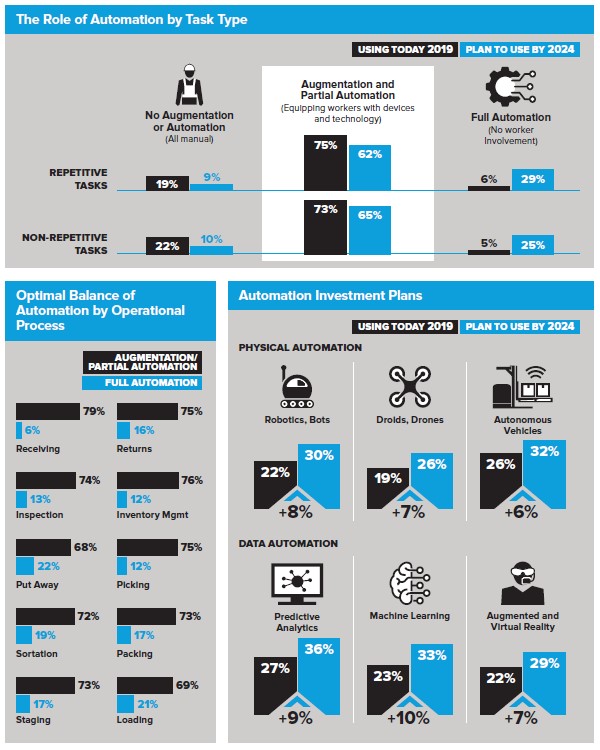

Warehouse leaders are pursuing new approaches to optimize productivity, efficiency and accuracy. Strategies range from continuing with mostly manual processes, to optimizing labor by enabling workers with devices and technology, to deploying full automation. Not surprisingly, only a small number (16%) of respondents selected full automation (no human involvement) as an optimal solution for operational processes.

Achieving Balance

The study reveals that decision makers think automation and employees need to work side- by-side to achieve maximum efficiencies. More than 70% of respondents believe there will be human involvement in workflows. Of those respondents, 39% agree adding an automation component to workers’ routines creates the optimal balance for warehouse operations.

As any warehousing leader understands, attracting, hiring and retaining a new generation of workers is not a trivial task. Industry leaders must make working in a warehouse more desirable, and see technology as a key differentiator.

Warehouse leaders are exploring new ways to expand workers’ skill sets. Moreover, 88% of respondents state that worker comfort and ergonomics are their top labor initiatives over the next five years. Seventy- nine percent of respondents also agree the warehouse environment will become a more desirable career because of the technological transformation taking place. Already, 54% of respondents are increasing supply chain and technical training to retain labor and develop a career path for valued employees.

Transforming the Workplace

While it’s true that automation will continue to make strides in the warehouse, it will not result in a net elimination of jobs. On the contrary, automation will create new jobs and enrich existing roles. According to Harvard Business Review, “While [artificial intelligence] AI will radically alter how work gets done and who does it, the technology’s larger impact will be in complementing and augmenting human capabilities, not replacing them.”2

Workers already use handheld devices to read barcodes and radio-frequency identification (RFID) tags and robots to increase efficiency and minimize the risk of workplace injury. Drones inspect labels and take inventory counts. Picking, sorting and packing are also seeing a digital transformation with assisted and augmented-reality technologies providing visual cues to workers through heads-up displays paired with scanners to validate multi-step workflows. And this is just the beginning.

Top Labor Initiatives

- Worker comfort and ergonomics

- Optimizing the use of temporary/seasonal labor

- Increasing training to retain labor and developing career paths

- Training labor more quickly to reduce time and expense

- Recruiting labor with more technical skill sets

- Addressing labor shortages

- Replacing an aging workforce

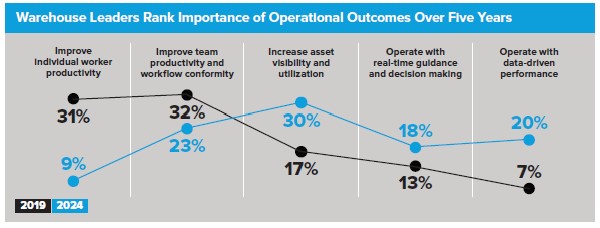

The path to modernization

Industry leaders report that warehouse modernization is vital to transforming operations and addressing critical challenges. To truly modernize a warehouse, however, decision makers must concentrate on three distinct areas and ensure they are synchronized: the warehouse management system (WMS), devices and the infrastructure workers use to improve overall workflow performance and automation.

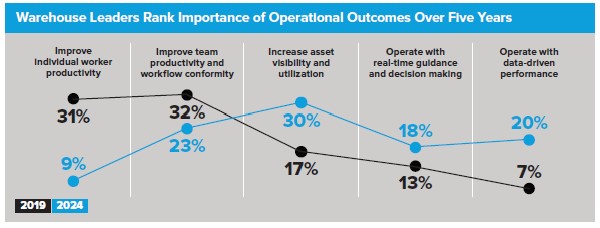

Taking an incremental approach that evaluates each area to ensure warehouse operations work efficiently and in harmony with employees will yield the highest rewards. Today, organizations are focusing on investments that deliver positive outcomes in individual and team productivity as well as workflow conformity. In five years, the pendulum will swing to increasing visibility, real- time guidance and data-driven performance.

Progress Through Innovation

Creating a smarter warehouse starts with workers on the front line and the operation’s system of record, the WMS, then adds automation to the flow of data and physical assets alike. With all this in sync, operations increase visibility, have real-time guidance and decision making and can achieve data driven performance.

Workers remain on the front lines of capturing data and tracking inventory. As individual performance improves and the environment gets smarter, team workflows become more productive, leading the way to more asset visibility and actionable, real-time decisions.

77% of respondents agree they need to modernize their warehouse operations but admit they are slow to implement new devices and technology

Seventy-seven percent of respondents agree they need to modernize their warehouse operations but admit they are slow to implement new devices and technology. Deploying new processes and technologies requires both a financial and time commitment and often necessitates extensive testing, validation and retraining that can slow down and sometimes derail production – both unacceptable outcomes in a strained supply chain. Forward- looking decision makers must be deliberate in their approach, invest wisely and proceed cautiously.

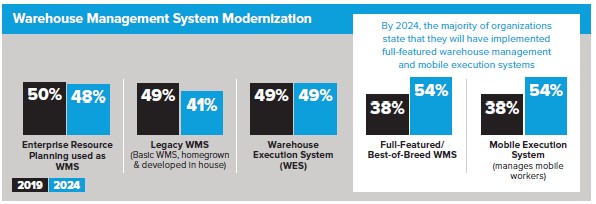

Hyperconnected warehouses are becoming a reality

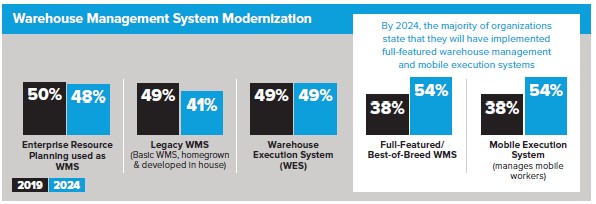

The WMS is the foundational system of record that manages everything throughout the warehouse – goods, assets, people, workflows and transactions. In any process, starting with improvements to the foundation is a logical first step and warehouse modernization is no exception. Over the next five years, decision makers will upgrade or add additional modules to their existing WMS or migrate altogether to full-featured, best-of-breed systems. These systems will enhance the mobile-user experience and allow for new inputs that enable data-driven performance.

Improving Productivity

Outfitting warehouse operations with modern-day WMS solutions enhances the employee user experience and is a significant focus for decision makers. Evolving devices from a terminal emulation interface to a graphical user interface will be key to ensuring that WMS processes are executed quickly and consistently. Today, 73% of organizations plan to begin modernization by equipping workers with mobile devices.

As part of this process, 83% of respondents report they are currently using or planning to use the Android™ operating system in the warehouse by 2024, which will provide a modern-touch interface. With Android implementation, leaders expect to improve worker efficiency (43%), increase their ability to adapt to new workflow complexities (39%) and stabilize performance amid workforce variability (39%).

The Power of Real-Time Information

The WMS of the future must have the capability to include real-time data from location-aware solutions, sensors and systems located throughout the enterprise. As decision makers focus on greater asset visibility and utilization, real-time guidance and data-driven performance, these advanced WMS features are essential to ensure warehouse optimization.

Today, 43% of organizations plan to implement real-time location systems (RTLS). Fifty-five percent of decision makers plan to continue to evolve their RTLS solutions or implement new solutions of this type by 2024. Over the next five years, an average of 80% of warehouse operators plan to have their WMS communicate with both their yard and transportation management systems to ensure synchronization across the supply chain.

Enabling Data-Driven Decisions

With the increased use of both automation and a highly mobile, connected workforce, the WMS needs to be able to direct the actions of both systems and workers. The implementation of warehouse execution systems (WESs) will remain stable over the next five years for 49% of organizations. The study results also revealed a 15% increase in the implementation of mobile execution systems to manage workers using connected devices by 2024. The two most used WMS functionalities by almost 70% of organizations today are labor planning and management and inventory tracking.

Optimizing workflows by augmenting workers and the environment with technology

The fast pace of the on-demand economy has increased pressure on supply chain and IT leaders to ensure labor is consistently performing at peak operational levels. Over the next five years, decision makers plan to invest in advanced infrastructures and automation that augment human capabilities and work in lockstep with WMS enhancements.

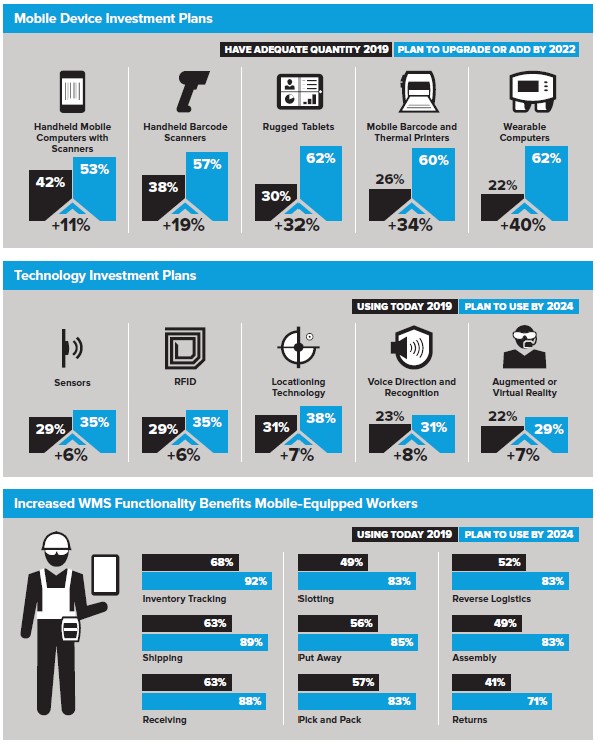

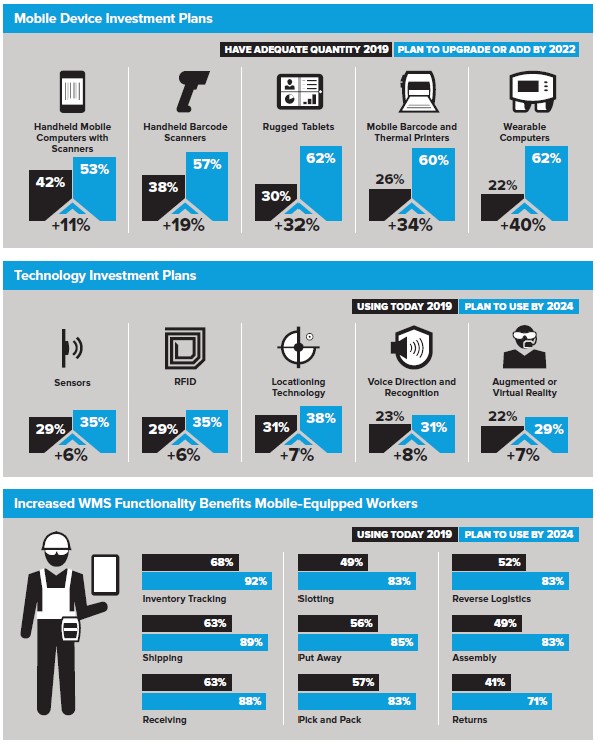

Mobility in the Warehouse

Decision makers plan to invest in a variety of device form factors to help people work smarter, faster and more accurately. Study respondents indicated significant increases in investments in rugged tablets, industrial scanners, wearable computers, such as smart watches, smart glasses and hip- mounted devices, as well as mobile and stationary printers. Up to 62% of decision makers will upgrade or add these devices over the next three or more years.

Materials need a digital voice to provide the level of visibility and accuracy needed for the modern-day supply chain. Unexpectedly, less than one-third of respondents report carton and item level barcoding of the majority (75%+) of their inbound items.

77% of respondents agree that augmenting workers with technology is the best way to introduce automation in the warehouse

Decision makers’ investment plans for more mobile barcode label and stationary printers are a sign that this is an area they plan to improve. While barcoding will remain the preferred approach in materials identification, RFID will continue to grow across all operations, particularly in inventory management, picking and cross docking.

Smarter Warehouses Take Center Stage

Decision makers will shift their focus over time from augmenting the individual worker and optimizing workflows for teams and associates to creating smarter facilities. The new, smarter warehouses will continuously capture information through sensors, analyze data to provide actionable intelligence and act on those insights in real time.

Sensors, RFID and indoor location solutions help automate the data capture process and free up workers for tasks that require human interaction. Thirty-six percent of decision makers believe they will use these technologies within five years to begin augmenting their environment with more automated data capture and asset tracking to increase accuracy and speed.

Within five years, respondents indicated an 8% increase in the use of voice direction and recognition and about one-third reported augmented or virtual reality will be guiding workers through workflow processes.

Outfitting warehouses with expanding levels of automation

New technologies and automation will play a critical role for warehouse operators as they strive to remain competitive. Forward-thinking leaders have already made substantial investments in fixed automation solutions for handling, picking, packing, sorting and moving goods. They are also turning to new technology innovations and flexible leasing strategies to enhance productivity and workflow efficiencies.

Today, automation is looking a bit different to decision makers. The need for flexibility and portability

is paramount to the ebb and flow of warehouse operations, particularly during peak seasonal

rushes. Organizations need the ability to move or lease automated technology to meet their fast- changing needs.

90% of decision makers expect devices or automation to be involved in completing non-repetitive tasks in the next five years

Robotic conveyor systems, cobots and autonomous vehicles provide the level of flexibility and portability required by state-of- the-art warehouses. Within the next five years, decision makers will increasingly turn to robotic material handling solutions. Respondents showed a marked increase in the adoption of these automated technologies, with growth projections rising by 6% to 8% within five years. Anticipated uses for robotics include inbound inventory management (24%), packing (22%) and goods in/receiving (20%) by 2024.

Streamlining Workflows

Automation improves labor productivity and compliance. Repetitive tasks, such as scanning, sorting and picking, are performed quickly and consistently. Travel time across a facility is reduced, which frees up workers to focus on more important tasks.

Currently, 94% of respondents report that repetitive tasks are completed with human involvement. However, 75% are enhancing the performance of workers by equipping them with purpose-built devices and technology to increase efficiency, speed and accuracy. By2024, however, 29% of decision makers indicate they plan to deploy full automation for some repetitive tasks.

Rising Importance of Predictive Analytics and Machine Learning

Automation is generally thought of as something you can see and touch, such as cartons on a conveyor or cobots interacting with workers in aisles. Increasingly, however, data analytics is emerging as one of the most critical aspects of warehouse automation.

Within five years, warehouse leaders plan to add new levels of intelligence to their operations to aid in the decision-making process. For workers, this means the ability to use data to predict what will happen or prescribe what should happen. For material handling, this automation translates into smarter solutions that can handle more complex tasks.

Decision makers are planning to increase data-driven performance by implementing predictive analytics for inbound and outbound operations (36%) and utilizing machine learning (33%) to improve decision making with real-time guidance.

Sixty-five percent of respondents still expect human interaction for non-repetitive tasks, but with the added benefit of receiving prompts with the next-best-move, or an automated assist.

Capturing a competitive edge in the digital age

Surviving and thriving in the new on-demand economy requires all segments of the supply chain to adapt and work together seamlessly. By rethinking how they meet rising demands and improve workflows, manufacturers, retailers, third-party logistics (3PLs) organizations and storage and delivery businesses are employing unique strategies to increase their competitive positions.

Manufacturers

Improving Response Times

As the on-demand economy and industry pressures from their customers create the need for quicker turnaround and new fulfillment strategies, manufacturers plan to work smarter and better optimize space. A resounding 86% of manufacturing organizations report implementing or planning to implement item-level shipping by 2024. And 78% are deploying or are planning to deploy reverse logistics solutions within the same timeframe. In addition, they will need to ensure they stock only the items they need. This approach decreases waste, reduces the cost of storing inventory and leads the way toward implementing Just-in-Time manufacturing, which 84% of organizations plan to adopt within five years.

Retailers

Accelerating the Speed of Fulfillment

With e-commerce exploding and online marketplaces growing rapidly, demands for faster delivery are expected to increase causing merchants to rethink their fulfillment strategies. Eighty-two percent of retailers surveyed are working on implementing regional/near-shoring of fulfillment centers to get closer to their customers. However, retailers seem mixed in their plans to address growing online order fulfillment. Eighty-six percent of those surveyed are establishing dedicated fulfillment centers. An equal number (86%) of respondents said they will fulfill online orders out of the same distribution centers as those serving brick and mortar stores

Third-Party Logistics Providers

Expanding Reach

An area of particular growth is third-party logistics (3PLs), which shows no signs of slowing down. Over the past five years, third-party logistics operations have experienced significant growth in manufacturing e-commerce (+30%) and retail (+26%), followed by expansion in the telecommunications (+28%) and wholesale distribution (+24%) industries. Eighty-three percent of respondents are turning to 3PLs to manage their warehouse and distribution center operations as well as the returns process.

Trucking, Postal, Couriers and Warehouse Storage

Streamlining Efficiencies

The increase in shipments is providing an opportunity for warehouse storage and delivery firms to work together to help reduce their carbon footprint. By optimizing how trailers are packed, companies can increase shipping volumes without the need to proportionally increase the size of their fleet. Fifty-four percent of respondents state they are currently implementing trailer load optimization, while an additional 40% plan to implement this process by 2024.

Regional study findings

Asia-Pacific

- By 2024, 87% of respondents plan to implement a mobile execution system to better manage workers on the warehouse floor.

- Seventy-three percent of decision makers plan to invest in smart watches, smart glasses and hip-mounted wearables in the next three years.

Europe

- The square footage of the average warehouse is projected to increase by 26%—more than in any other region—in the next five years.

- By 2024, RFID and location technology usage are anticipated to increase for outbound operations with more than one in five planning to use them for packing (25%), inventory

management (20%) and picking (19%).

Latin America

- Latin American decision makers identified labor efficiency or productivity (71%) as the top operational challenge of the next five years.

- Ninety-five percent of organizations plan to implement Android- based mobile computers in the warehouse by 2024 to help improve worker productivity and efficiency.

North America

- Almost half (49%) of North American decision makers identified outbound packing, staging and loading as a challenge.

- Ninety-four percent of respondents will have implemented or plan to implement trailer load optimization and/or load compliance solutions

by 2024.

Warehousing of the future

Warehouse leaders are turning to technology to address critical challenges and prepare for the rapidly expanding on-demand marketplace. Decision makers plan to take an incremental approach to warehouse modernization by first focusing on their most valuable assets, their workers. By providing training and improving working conditions, they plan to offer workers a career path that is complemented by the use of technology.

In the near future, after they’ve laid the groundwork by implementing a full-featured WMS, improving teamwork, and utilizing advanced technologies, warehouses will integrate more holistic solutions.

This process will enable them to build data-powered environments that balance labor and automation in the warehouse, ultimately empowering front-line workers with a performance edge.

Zebra empowers the front line of business to achieve a performance edge. We deliver industry tailored, end-to-end solutions that intelligently connect people, assets and data to help our customers make business-critical decisions.

1Voice Information Associates, Voice Technology in the Supply Chain (VSC) Markets, Products & Suppliers, 2019

2Wilson, James H., Daugherty, Paul R. Harvard Business Review, Collaborative Intelligence: Humans and AI Are Joining Forces, July-August 2018

Turning the Supply Chain Upside Down

Turning the Supply Chain Upside Down